Credit finance for welding equipment

Are you thinking of spreading the cost of your purchase?

Finance is a great way to spread the cost of your purchase, if used responsibly. We have teamed up with Omni, one of the UK’s leading finance specialists, so that you can apply for and complete a loan application quickly and easily – the online application process only takes a couple of minutes to complete, and you will receive confirmation of whether your application has been successful, or referred for further consideration, instantly.

More about our finance options

Our monthly payment plans are designed to help make your purchase more affordable.

We offer:

• A payment terms between 6 and 36 months

• APRs from 0% to 14.9%

The value of the loan needs to be over £250 and no more than £25,000 and you can choose a deposit of up to 50% of the value of the goods.

It’s important to remember that you should only enter into a finance agreement if you are sure you can afford the repayments for the full term of the loan. Whichever finance option you choose to apply for, you need to be sure that you can afford to pay the deposit, and keep up with your monthly repayments. You should think about any changes to your situation that might occur during the term of the loan, which could affect your income or expenditure, for example – retirement, moving home, changing jobs, or any health issues.

Check your Eligibility

You can be considered for finance if you:

• Are at least 18 years old

• Are a permanent UK resident and have lived in the UK for at least 3 years

• Have a gross annual income of at least £5,000

• Have a UK bank account capable of accepting Direct Debits

• Have a good credit history with no late payments, Debt Relief Orders, County Court Judgments or bankruptcies

• Meet any other Omni criteria

Finance examples

We offer a range of interest-free and interest-bearing finance options to help you spread the cost of your purchase over 6 to 36 months .

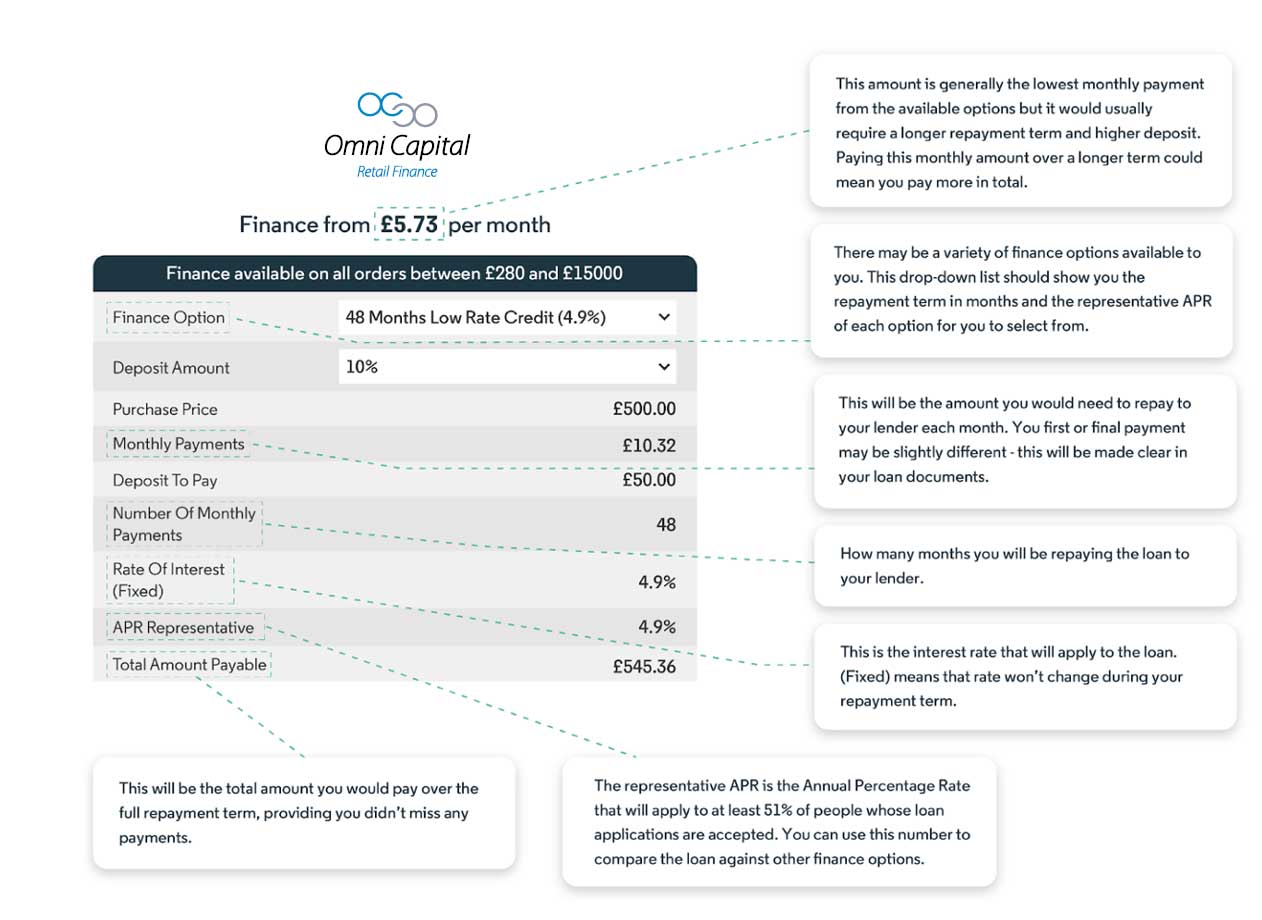

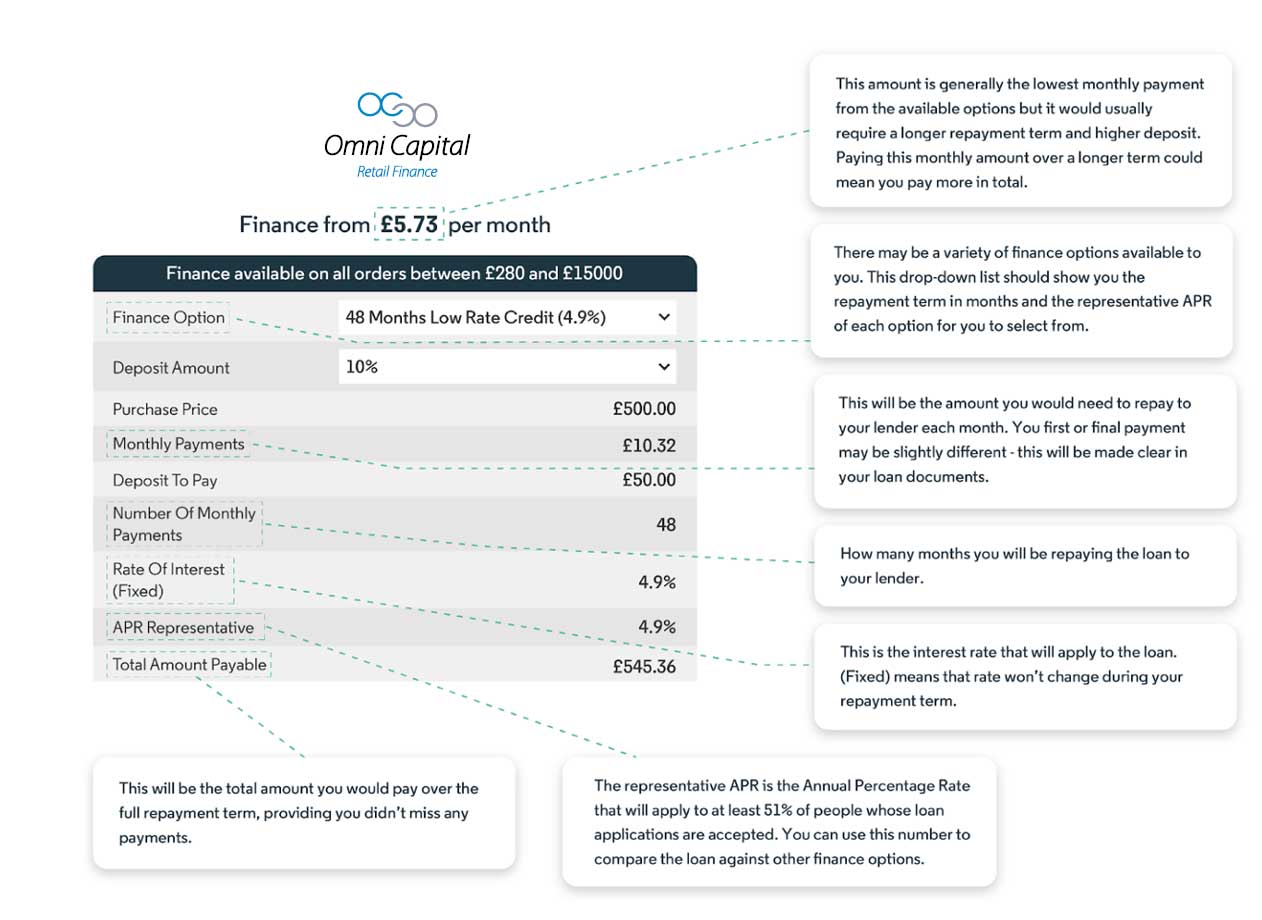

Understanding the numbers

Make sure that you understand the costs, terms and key features of the finance options available to you. You will see this information as you shop and at checkout.

Use our finance calculator at checkout to see how different loan values, terms and interest rates affect the total amount you need to pay and the monthly repayments. The finance calculator is for illustrative purposes only and is not a quote, or formal offer of finance. The offer you receive if you apply will be dependent on your personal circumstances and the lender’s policies.

It’s important that you understand what this information means for you before you decide to apply for finance. The numbers and information you see when taking out finance can be overwhelming and so a simple guide is below to help you.

Here is an example of what you might see at checkout, with some handy explanations to help you understand what it all means. Please note that this is just an example, the format, layout and content of checkout finance calculators may vary.

Whichever finance option you choose to apply for, you need to be sure that you can afford to pay the deposit, and keep up with your monthly repayments. You should think about any changes to your situation that might occur during the term of the loan, which could impact on your finances - e.g. retirement, moving home, changing jobs, or any health issues which could affect your income or expenditure.

Alongside the finance calculator and on some of our promotional banners, you will also see the representative example. This could be written in a sentence, as shown in the example below, or in a table format:

Representative example

Cash price £500.00, Deposit £50.00. Total amount of credit £450.00 over 48 months with an annual interest rate of 4.9% (Fixed). Monthly repayments will be £10.32 with a total repayable of £545.36. 4.9% APR representative.

The representative example shows the finance information that we expect to apply to more than half of accepted applications for the specific amount and repayment term.

As we mentioned earlier, the representative example is not a quote or formal offer of finance - we display this to help you understand how much a loan will cost, and so you can compare it with other products.

Whilst these numbers are there to help you understand what a loan will cost you, it’s important that you understand any other potential costs in the terms and conditions of the finance option you select. For instance, you may be charged missed or late payment fees if you don’t keep up with your payments.

Our finance provider – Omni Capital Retail Finance

You’re in safe hands with our finance provider, Omni Capital Retail Finance. Omni was founded in 2009,

is part of Castle Trust Group, and is one of the

UK’s leading finance specialists. It is authorised and regulated by the Financial Conduct Authority (reference number 720279).

Paying with finance

The process for making your purchase using finance couldn’t be easier. Simply:

• Place the item(s) in your basket

• In checkout select finance as payment option

• Choose your payment plan (length of loan and deposit %)

• Click on Apply for Finance

• Complete the application

• Wait for your order to arrive

FAQ's

Finance Decision

Applying for a loan: Am I eligible to apply for finance?

You may be elegible for finance if you:

• Are at least 18 years old

• Have a gross annual income each year of more than£5,000.

• Are a permanent UK resident and have lived in the UK for at least 3 years.

• Have a UK bank account capable of accepting Direct Debits.

• Are not currently bankrupt, subject to an Individual Voluntary Agreement (IVA), or have any country Court Judgements (CCJs).

• Provide an email address so your documentation can be emailed to you.

Will a credit search be registered against me if I apply?

Omni will perform a 'soft' credit search on your credit file as part of their assessment, to determine whether the loan is affordable for you and if you are likely to make your repayments on time.

It’s important to know that an application for credit will only result in a ‘soft’ search on your credit file until the point your application for finance is complete, at which point a 'hard' credit check will be recorded on your credit file. Only you can see that a 'soft' search has been made on your credit file, but a 'hard' credit check will be visible to others viewing your credit file, for example, if you apply for credit in the future, the lender will see that an application credit search was made on your credit file.

What happens after I have submitted my application?

Your application will be assessed based on eligibility, credit history and affordability and Omni will let you know the outcome in just a few seconds.

Your application may be referred to a lender for manual assessment and you may receive a request for additional information to support your application.

What happens if my application is accepted?

Once your application is accepted you will be prompted to review and sign your credit documentation. This documentation will detail all the important information about your loan and should be read carefully.

What happens if my application is referred to an Underwriter?

You will receive a response from the Underwriter within 20 minutes of the application being referred during normal working hours. This can either be an accept, decline or a request for more information. If more information is requested, you will receive an email detailing the information required. If you have any questions, you can contact the Underwriting Team at underwriting@ocrf.co.uk.

What happens if my application is declined?

If your application was declined, Omni may be unable to give you specific reasons why. Omni use information from your credit report, alongside your income and expenditure data to make a lending decision. You will receive an email which will provide further details of the Credit Reference Agencies and contact information for any queries you may have.

You can also contact the Credit Reference Agencies if you think there is a mistake on your credit report:

Managing my loan: When do my monthly repayments start?

After your goods or services have been provided your loan will be activated. Your first Direct Debit payment will be taken approximately 30 days after you receive your welcome email from Omni. This will show on your statement as a payment to Omni.

You can request to change your monthly payment date after the first payment has been made by contacting Omni and speaking to their customer services team on 0333 240 8317. You will also be registered for their Customer Self Service portal, where you will be able to change the payment date yourself.

How can I contact the lender to discuss my loan?

There are three ways to contact Omni:

• Through the Customer Self Service Portal.

• By email at customerenquiries@ocrf.co.uk

• By telephone on 0333 240 8317.

Are there any fees for repaying my loan early?

There may be a fee for early repayment depending on the type of loan. Your Credit Agreement will detail the applicable fees for your product.

Can I cancel my finance agreement?

You have 14 days to cancel your credit agreement, please note that to cancel your goods and services you will need to speak to us directly. Cancelling your finance agreement with Omni without cancelling the goods and services will mean payment for the goods and services will still be required.

If I need to make a complaint, who do I contact?

f you are unhappy with the level of service Omni have provided or anything Omni have done, you can let them know in the following ways:

• By telephone on 0333 240 8317.

• Email: complaints@ocrf.co.uk.

• By Post: Complaints, Omni Capital Retail Finance Ltd, Customer Services, PO Box 6990, Basingstoke, Hampshire, RG24 4HX.

Financial Difficulties: Who do I speak to if I want to discuss my loan, or I’m having trouble with my repayments?

Information about how Omni can support you if you miss a repayment can be found on their website: https://omnicapitalretailfinance.co.uk/money-worries/

Use of personal data

To process your application, you will be asked to provide information about your personal, employment and financial situation. Omni Capital Retail Finance Limited will use your data to determine your finance offer. They will also perform a search with one or more Credit Reference Agencies to conduct checks for creditworthiness and any affordability assessments to help them make their decision.

You can find out more about how Omni Capital Retail Finance Limited uses and protect your personal data at https://www.omnicapitalretailfinance.co.uk/privacy-policy/.

Omni Capital Retail Finance Limited will provide you with a copy of their Privacy Policy with your loan documents.

Cancellations and Returns

I want to return my goods and cancel my finance agreement.

Please see our R-Tech Terms and Conditions . Some products cannot be cancelled, for example, made-to-order or bespoke goods, so you should check this before you complete your purchase.

Where you do have the right to cancel, you must do this within 14 days of entering into the finance agreement.

To cancel your finance agreement, please contact us (your retailer) and arrange to return your purchase or cancel the services. Once we have confirmed cancellation, we will advise your lender to cancel your finance agreement and refund any payments that have been made. If you made your purchase in-store, we will refund any deposit payment that you made. Your finance agreement can only be cancelled by your lender if your purchase is cancelled with us.

What happens to my loan if I want to return my order?

If you are not satisfied with your purchase you can return it up to 30 days after delivery. In this case, we will notify your lender to reduce your loan amount accordingly. You will receive confirmation from your lender within 3-5 business days after we received your return in cases where a full refund is processed.

Legal Information - Financial Disclosure

R-Tech Welding Equipment Ltd is registered in England and Wales with company number 06310207. Registered address: 5300 Severn Drive, Tewkesbury Business Park, Tewkesbury, Gloucestershire. GL20 8SF. Terms and Conditions can be found here. R-Tech Welding Equipment Ltd acts as a credit broker and offers credit products from different lenders. R-Tech Welding Equipment Ltd is authorised and regulated by the Financial Conduct Authority, registration number: FCA number (FRN 674991)

0% finance with a term of 12 months or less is not regulated by the Financial Conduct Authority.